Your Where to fill home loan interest in itr images are available in this site. Where to fill home loan interest in itr are a topic that is being searched for and liked by netizens today. You can Get the Where to fill home loan interest in itr files here. Get all free images.

If you’re searching for where to fill home loan interest in itr pictures information linked to the where to fill home loan interest in itr interest, you have visit the ideal site. Our website always provides you with hints for seeing the maximum quality video and picture content, please kindly hunt and locate more enlightening video articles and graphics that fit your interests.

Where To Fill Home Loan Interest In Itr. Section 80EE of the ITA provides for deduction of interest on home loan taken for a residential house property. Add up if you have any pre construction interest on home loan mentioned at bottom. Click on Finish with Rent and Interest. Fill in personal details such as your name Aadhar number and address.

Income Tax Benefits On Housing Loan In India Sag Infotech From blog.saginfotech.com

Income Tax Benefits On Housing Loan In India Sag Infotech From blog.saginfotech.com

Now with regard to filing income tax return for home loans you have to follow these steps-. If I put the amount in schedule-HP in the cell for interest payable for borrowed capital h things are coming corectly but ultimately it is not getting deducted from my salary amount rather in part-B TI-TTI it is shown to be carried forward to. Tick the box for self-occupied property. If you have a housing loan on a self-occupied House Property declare interest on loan Enter the address of the house and specify co-owners if any. Provide the Home Loan details and click on Next Step. 200000 in the case of self-occupied property and without any limit in case of property is rented out subject to the possession conditions mentioned above.

The eligibility of this tax deduction has been extended till 31 March 2022.

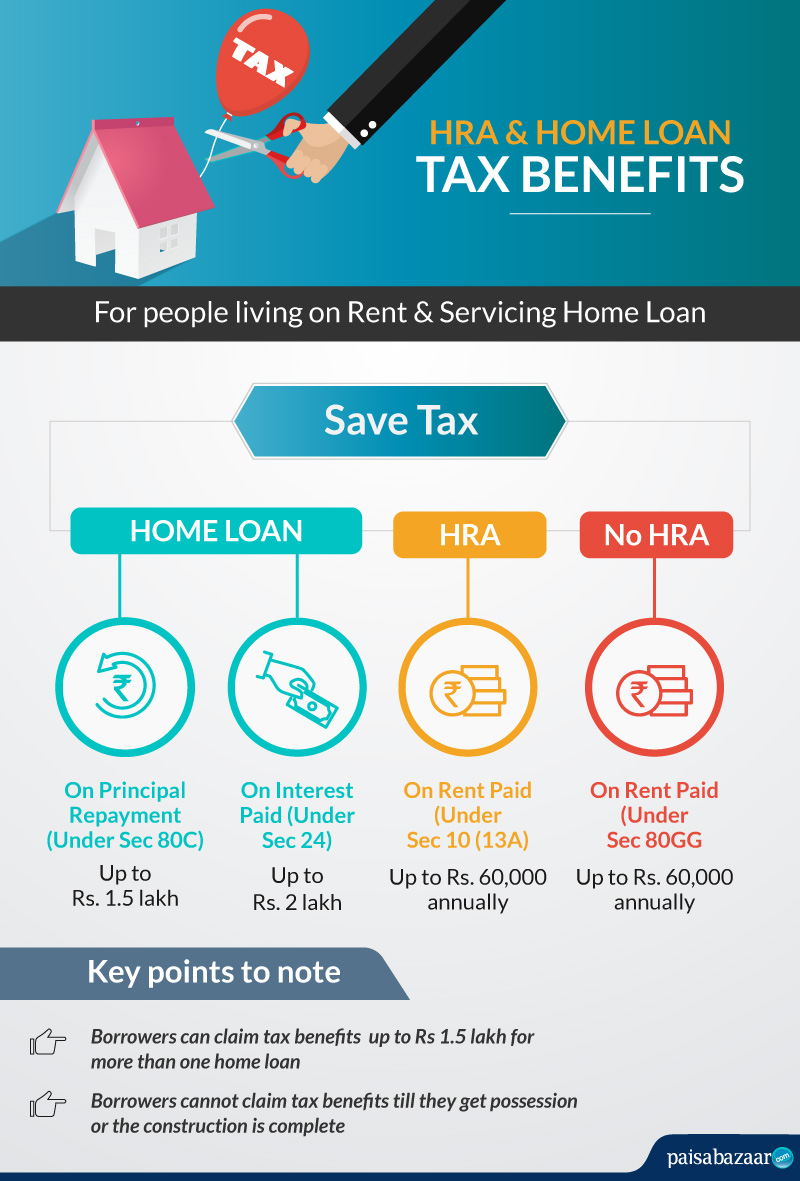

Your reported housing loan details will be shown. If you have a housing loan on a self-occupied House Property declare interest on loan Enter the address of the house and specify co-owners if any. So lets understand where to Show Housing loan Interest in ITR-1. Provide the Home Loan details and click on Next Step. Login to cleartax Start filing tax return Deductions Deduction us 80C Interest on the home loan shall be allowed as deduction us 24 subject to a limit of Rs. If the loan is taken jointly then each of the loan holders can claim a deduction for home loan interest up to Rs 2 lakh each and principal repayment us 80C up to Rs 15 lakh each in their individual tax returns.

Source: bemoneyaware.com

Source: bemoneyaware.com

200000 in the case of self-occupied property and without any limit in case of property is rented out subject to the possession conditions mentioned above. As we have already understood there are three sections Section 24 Section 80EE section 80EEA which allow the taxpayer to penetrate interest paid on home loan under exemption head. So lets understand where to Show Housing loan Interest in ITR-1. In banks and other financial institutions that offer secured personal loans the EMI on these loans vary and these interest rates keep changing as per RBIs monetary policy. This is apart from the exemption of up to Rs2 lakh on home loan interest rates which comes under Section 24 of the Income Tax Act.

Source: investopedia.com

Source: investopedia.com

The format in which rental income shall be reported in ITR has been explained with an. Add up if you have any pre construction interest on home loan mentioned at bottom. Step 8 Enter the Total of your Section 80C deductions LIC Mutual Funds etc Declare all other deductions which are applicable. Reporting house property income in ITR-1 Certain information such as type of house property details of income from house property shall be pre-filled from last year ITR and Form 26AS. This is apart from the exemption of up to Rs2 lakh on home loan interest rates which comes under Section 24 of the Income Tax Act.

Source: in.pinterest.com

Source: in.pinterest.com

The format in which rental income shall be reported in ITR has been explained with an. 200000 in the case of self-occupied property and without any limit in case of property is rented out subject to the possession conditions mentioned above. Provide the Home Loan details and click on Next Step. 1 Yes you can claim housing loan interest under house property income and repayment of housing loan under section 80C. Income from House Property.

Source: zeebiz.com

Source: zeebiz.com

As we have already understood there are three sections Section 24 Section 80EE section 80EEA which allow the taxpayer to penetrate interest paid on home loan under exemption head. Your reported housing loan details will be shown. Provide the Home Loan details and click on Next Step. So lets understand where to Show Housing loan Interest in ITR-1. Now with regard to filing income tax return for home loans you have to follow these steps-.

Source: paisabazaar.com

Source: paisabazaar.com

Fill in personal details such as your name Aadhar number and address. In the July 2019 Budget there was an additional income tax deduction of up to Rs15 lakh for home loans for affordable housing projects. Your reported housing loan details will be shown. 200000 in the case of self-occupied property and without any limit in case of property is rented out subject to the possession conditions mentioned above. Add up if you have any pre construction interest on home loan mentioned at bottom.

Source: mytaxcafe.com

Source: mytaxcafe.com

Step 8 Enter the Total of your Section 80C deductions LIC Mutual Funds etc Declare all other deductions which are applicable. Provide the Home Loan details and click on Next Step. Enter your income chargeable under the head Salaries and enter this figure after checking Form 16. To claim interest on Home Loan fill this section. This is apart from the exemption of up to Rs2 lakh on home loan interest rates which comes under Section 24 of the Income Tax Act.

Source: pinterest.com

Source: pinterest.com

200000 in the case of self-occupied property and without any limit in case of property is rented out subject to the possession conditions mentioned above. Like most of the Bank Add 3 years net Income divide by 3 the average income consider the current income of the applicant and Multiply by 5 or 6 time. Section 80EE of the ITA provides for deduction of interest on home loan taken for a residential house property. Step 8 Enter the Total of your Section 80C deductions LIC Mutual Funds etc Declare all other deductions which are applicable. To claim this deduction they should also be co-owners of the property taken on loan.

Source: cleartax.in

Source: cleartax.in

Login to cleartax Start filing tax return Deductions Deduction us 80C Interest on the home loan shall be allowed as deduction us 24 subject to a limit of Rs. Tick the box for self-occupied property. How to fill Housing Loan Interest in ITR 1 - YouTube. The format in which rental income shall be reported in ITR has been explained with an. As we have already understood there are three sections Section 24 Section 80EE section 80EEA which allow the taxpayer to penetrate interest paid on home loan under exemption head.

Source: livemint.com

Source: livemint.com

If I put the amount in schedule-HP in the cell for interest payable for borrowed capital h things are coming corectly but ultimately it is not getting deducted from my salary amount rather in part-B TI-TTI it is shown to be carried forward to. I am trying to fill ITR-2 myself for the first time and have few doubts. 200000 in the case of self-occupied property and without any limit in case of property is rented out subject to the possession conditions mentioned above. Claim Interest on Home Loan Deduction and Principal Repayment Under Section 80C In case there is Principal Repayment by you during the year check your loan instalment details principal repayments are allowed to claim interest on home loan deduction under section 80 C. How do I claim deduction of the amount paid towards home loan interest in ITR-2.

Source: no.pinterest.com

Source: no.pinterest.com

200000 in the case of self-occupied property and without any limit in case of property is rented out subject to the possession conditions mentioned above. Enter Property Loan and Interest details and click on Next Step. Add up if you have any pre construction interest on home loan mentioned at bottom. To claim this deduction they should also be co-owners of the property taken on loan. 200000 in the case of self-occupied property and without any limit in case of property is rented out subject to the possession conditions mentioned above.

Source: pinterest.com

Source: pinterest.com

So here is the tutorial in reply to query of this lovely subscriberWatch. 1 Yes you can claim housing loan interest under house property income and repayment of housing loan under section 80C. Tick the box for self-occupied property. Your reported housing loan details will be shown. Deduction in respect of interest on loan taken for certain house property Please enter the amount paid during the year by way of interest on loan taken from any financial institution during the period 1 April 2019 to 31 March 2020 for the purpose of acquisition of a residential house property which is eligible for deduction us 80EEA.

Source: cleartax.in

Source: cleartax.in

The average rate of interest for home loans is anywhere between 825 and 14 in the market. This is apart from the exemption of up to Rs2 lakh on home loan interest rates which comes under Section 24 of the Income Tax Act. Section 80EE of the ITA provides for deduction of interest on home loan taken for a residential house property. Fill in personal details such as your name Aadhar number and address. How to fill Housing Loan Interest in ITR 1 - YouTube.

Source: pinterest.com

Source: pinterest.com

Reporting house property income in ITR-1 Certain information such as type of house property details of income from house property shall be pre-filled from last year ITR and Form 26AS. To claim this deduction they should also be co-owners of the property taken on loan. Reporting house property income in ITR-1 Certain information such as type of house property details of income from house property shall be pre-filled from last year ITR and Form 26AS. So lets understand where to Show Housing loan Interest in ITR-1. Click on Finish with Rent and Interest.

How to fill Housing Loan interest and principal in Income Tax Return Housing loan details in ITR - YouTube. 2 Yes till the time your house in under construction you can claim both HRA Housing loan interest. There is no thumb rule Reason because of Different Banks offer different Home Loan Product. Login to cleartax Start filing tax return Deductions Deduction us 80C Interest on the home loan shall be allowed as deduction us 24 subject to a limit of Rs. Add up if you have any pre construction interest on home loan mentioned at bottom.

Source: bankbazaar.com

Source: bankbazaar.com

Step 8 Enter the Total of your Section 80C deductions LIC Mutual Funds etc Declare all other deductions which are applicable. Fill in personal details such as your name Aadhar number and address. Javed asked me that where to fill Housing loan interest in ITR-1. How to fill Housing Loan interest and principal in Income Tax Return Housing loan details in ITR - YouTube. Section 80EE of the ITA provides for deduction of interest on home loan taken for a residential house property.

Source: youtube.com

Source: youtube.com

How to fill Housing Loan interest and principal in Income Tax Return Housing loan details in ITR - YouTube. Section 80EE of the ITA provides for deduction of interest on home loan taken for a residential house property. I am trying to fill ITR-2 myself for the first time and have few doubts. If you have a housing loan on a self-occupied House Property declare interest on loan Enter the address of the house and specify co-owners if any. In the July 2019 Budget there was an additional income tax deduction of up to Rs15 lakh for home loans for affordable housing projects.

Source: blog.saginfotech.com

Source: blog.saginfotech.com

To claim interest on Home Loan fill this section. Click on Finish with Rent and Interest. How to fill Housing Loan Interest in ITR 1 - YouTube. How do I claim deduction of the amount paid towards home loan interest in ITR-2. The format in which rental income shall be reported in ITR has been explained with an.

Source: housing.com

Source: housing.com

This is apart from the exemption of up to Rs2 lakh on home loan interest rates which comes under Section 24 of the Income Tax Act. This is apart from the exemption of up to Rs2 lakh on home loan interest rates which comes under Section 24 of the Income Tax Act. Tick the box for self-occupied property. 2 Yes till the time your house in under construction you can claim both HRA Housing loan interest. Provide the address details of the property and click on Save.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title where to fill home loan interest in itr by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.