Your Update how much vat tax if top up free images are ready in this website. Update how much vat tax if top up free are a topic that is being searched for and liked by netizens today. You can Download the Update how much vat tax if top up free files here. Download all royalty-free vectors.

If you’re searching for update how much vat tax if top up free pictures information connected with to the update how much vat tax if top up free keyword, you have come to the ideal site. Our website frequently gives you suggestions for refferencing the maximum quality video and picture content, please kindly surf and locate more enlightening video articles and graphics that fit your interests.

Update How Much Vat Tax If Top Up Free. You calculate 20 VAT by calculating the net amount x 120 then you have the gross amount. Account Management site for consumers. Every seller of goods and provider of services charges VAT from customers which in turn is paid to. Rate of additional tax with effect from 19 February 2010.

A Guide To Vat Tax Free Shopping In The Uk Visit Britain From visitbritain.com

A Guide To Vat Tax Free Shopping In The Uk Visit Britain From visitbritain.com

Value Added Tax VAT Google Play sales in which Google is the seller of record may be subject to Value Added Tax VAT or equivalent. ISLE OF MAN United Kingdom REUNION ISLAND France GST 2 10 VAT 20 VAT 21-85. Account Management site for consumers. Goods like precious stones gold bullion jewellery etc. If you think youre eligible for a tax refund. Before 1 July 2021 you can buy goods from outside the EU up to a value of 22 without incurring any VAT charges.

VAT 23 Duties 0-17 Duties 0-15 Duties 0-50 GST 10-50 on luxury goods ARUBA.

Raw wool 5 Animal hair 0. Entertainment duty stamps Passenger and goods tax stamp standard watermarked petition paper philatelic stamp Postal stationery and refund adjustment order. Goods falling under Schedule II other than declared goods as defined under the Central Sales Tax Act 1956. Rate of additional tax with effect from 19 February 2010. Some basic necessity goods are exempted such as wood salt etc. Fruit is subject to the reduced tax rate of 5 VAT.

Source: pinterest.com

Source: pinterest.com

We will continue to monitor the. If you want to know how much VAT is in the amount you calculate the gross amount 120 net amount 020. 4 or 5 and 1250. Update How Much VAT Tax If Top Up Free Fire Using Credit. Integrated Plus customers also benefit from free CPD up to 16 hours online or access to our Tax Planning Apps.

Source: docs.microsoft.com

Source: docs.microsoft.com

There are two sets of rates that are applicable for most goods. 3 Duties 0-485 Import Tax 0-7 under review AUSTRALIA. This goes up to 1000 every 3 months if a child. We will continue to monitor the. Manage Your Orders.

Source: elibrary.imf.org

Source: elibrary.imf.org

Now you go to the supermarket and buy fruit. This goes up to 1000 every 3 months if a child. VAT or Value Added Tax. Every seller of goods and provider of services charges VAT from customers which in turn is paid to. VAT forms an essential part of the GDP of any country and as such is an extremely important type of tax.

Source: pinterest.com

Source: pinterest.com

It might take up to 24 hours to process your request. Entertainment duty stamps Passenger and goods tax stamp standard watermarked petition paper philatelic stamp Postal stationery and refund adjustment order. Raw wool including animal hair. Skype Credit or when your Skype Credit is automatically topped up. Before 1 July 2021 you can buy goods from outside the EU up to a value of 22 without incurring any VAT charges.

Source: avalara.com

Source: avalara.com

You can get up to 500 every 3 months up to 2000 a year for each of your children to help with the costs of childcare. 3 Duties 0-485 Import Tax 0-7 under review AUSTRALIA. However the applicable VAT or GST-inclusive rates are applied when you use your Skype Credit to make calls send SMS or use any other paid Skype products. Every seller of goods and provider of services charges VAT from customers which in turn is paid to. If you want to know how much VAT is in the amount you calculate the gross amount 120 net amount 020.

Source: expatica.com

Source: expatica.com

A-VAT Solution is a leading software for filing VAT Tax returns in India. It might take up to 24 hours to process your request. How much is the VAT tax if we Top Up Free Fire using Indosat Credit now in the first example we will top up the Free Fire Level Up Pass at a price of 16K or 16000 Rupiah what is the VAT tax and how much total pulses we will spend. In terms of generating VAT returns you will find a huge list of softwares over the internet including the A-VAT Solution which is a team hard-work of SAG Infotech Pvt. If you want to know how much VAT is in the amount you calculate the gross amount 120 net amount 020.

Source: pinterest.com

Source: pinterest.com

Raw wool including animal hair. Account Management site for consumers. VAT Rates Different states apply different VAT Rates as per their implied laws. We have five Apps which cover tax calculation profit extraction incorporation options company car planner and top slicing from chargeable event gains. VAT or Value Added Tax.

Source: ezv.admin.ch

Source: ezv.admin.ch

In terms of generating VAT returns you will find a huge list of softwares over the internet including the A-VAT Solution which is a team hard-work of SAG Infotech Pvt. We have five Apps which cover tax calculation profit extraction incorporation options company car planner and top slicing from chargeable event gains. If you think youre eligible for a tax refund. Goods up to a value of 150 may be imported without payment of customs duty. Some basic necessity goods are exempted such as wood salt etc.

Source: docs.microsoft.com

Source: docs.microsoft.com

Account Management site for consumers. Recent updates and fixes in FastSpring. If you think youre eligible for a tax refund. We have five Apps which cover tax calculation profit extraction incorporation options company car planner and top slicing from chargeable event gains. To avoid these packages being stopped by Customs the value should be clearly marked on the label.

Source: expatica.com

Source: expatica.com

To avoid these packages being stopped by Customs the value should be clearly marked on the label. VAT or Value Added Tax. Entertainment duty stamps Passenger and goods tax stamp standard watermarked petition paper philatelic stamp Postal stationery and refund adjustment order. We will continue to monitor the. It might take up to 24 hours to process your request.

Source: pinterest.com

Source: pinterest.com

In terms of generating VAT returns you will find a huge list of softwares over the internet including the A-VAT Solution which is a team hard-work of SAG Infotech Pvt. VAT is tax on consumption of goods and services which is paid by the original producer when these goods and services are transferred to their ultimate consumers. Rate of additional tax with effect from 19 February 2010. Come under a VAT rate of 1 or 2. Natural gas when sold to specified dealers.

Source: pinterest.com

Source: pinterest.com

VAT Rates Different states apply different VAT Rates as per their implied laws. We have five Apps which cover tax calculation profit extraction incorporation options company car planner and top slicing from chargeable event gains. Skype is required to charge Value Added Tax VAT or Goods and Services Tax GST for products purchased by Skype customers in certain countries. ISLE OF MAN United Kingdom REUNION ISLAND France GST 2 10 VAT 20 VAT 21-85. 4 or 5 and 1250.

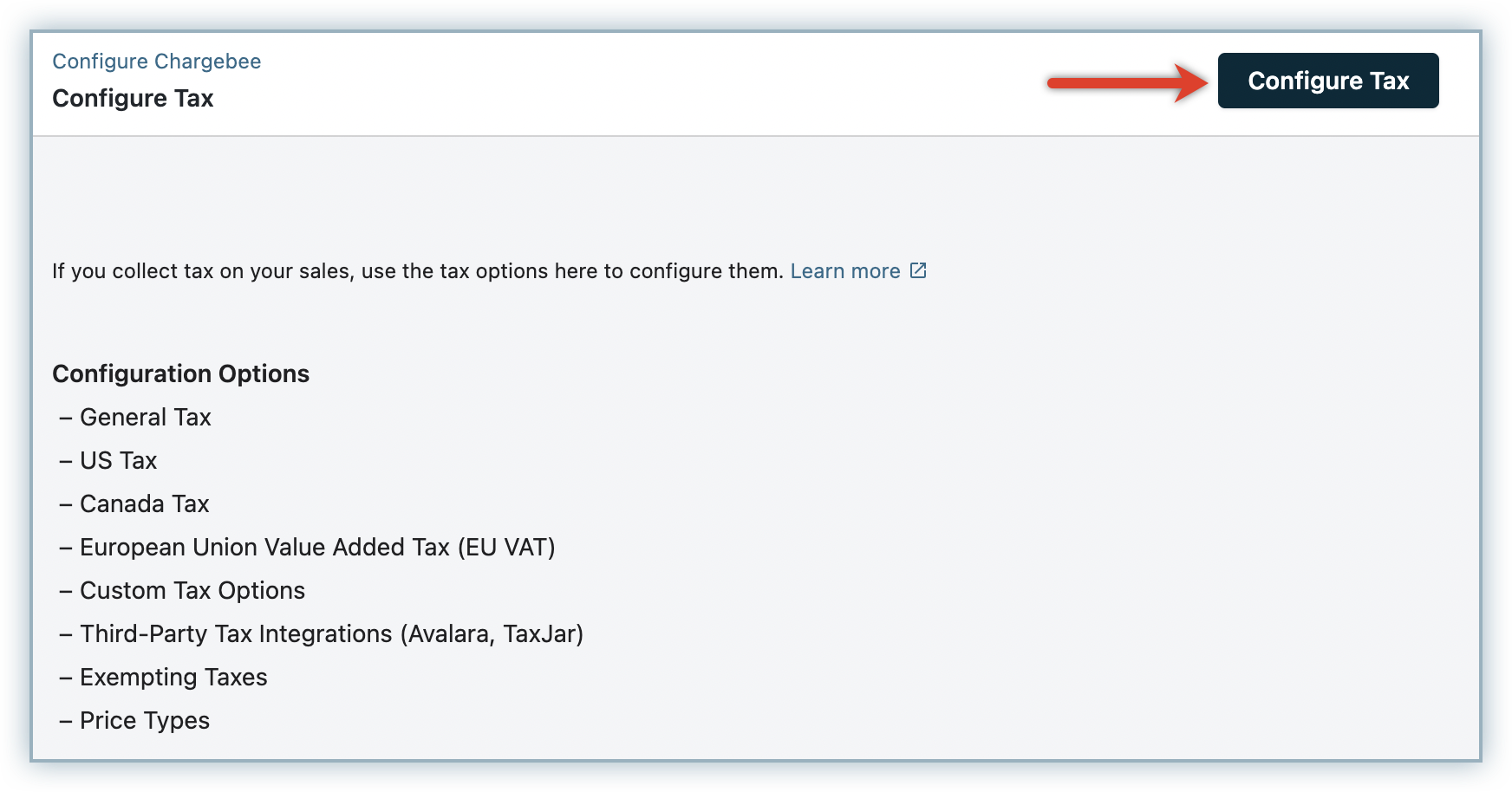

Source: chargebee.com

Source: chargebee.com

Value Added Tax VAT Google Play sales in which Google is the seller of record may be subject to Value Added Tax VAT or equivalent. This goes up to 1000 every 3 months if a child. Update How Much VAT Tax If Top Up Free Fire Using Credit. 4 or 5 and 1250. If you think youre eligible for a tax refund.

Source: en.selectra.info

Source: en.selectra.info

It was held that payments of service tax and VAT are mutually exclusive. However the applicable VAT or GST-inclusive rates are applied when you use your Skype Credit to make calls send SMS or use any other paid Skype products. Manage Your Orders. Raw wool including animal hair. You can get up to 500 every 3 months up to 2000 a year for each of your children to help with the costs of childcare.

Source: stripe.com

Source: stripe.com

Goods falling under Schedule II other than declared goods as defined under the Central Sales Tax Act 1956. VAT Rates Different states apply different VAT Rates as per their implied laws. Rate of additional tax up to 18 February 2010. Now you go to the supermarket and buy fruit. It was held that payments of service tax and VAT are mutually exclusive.

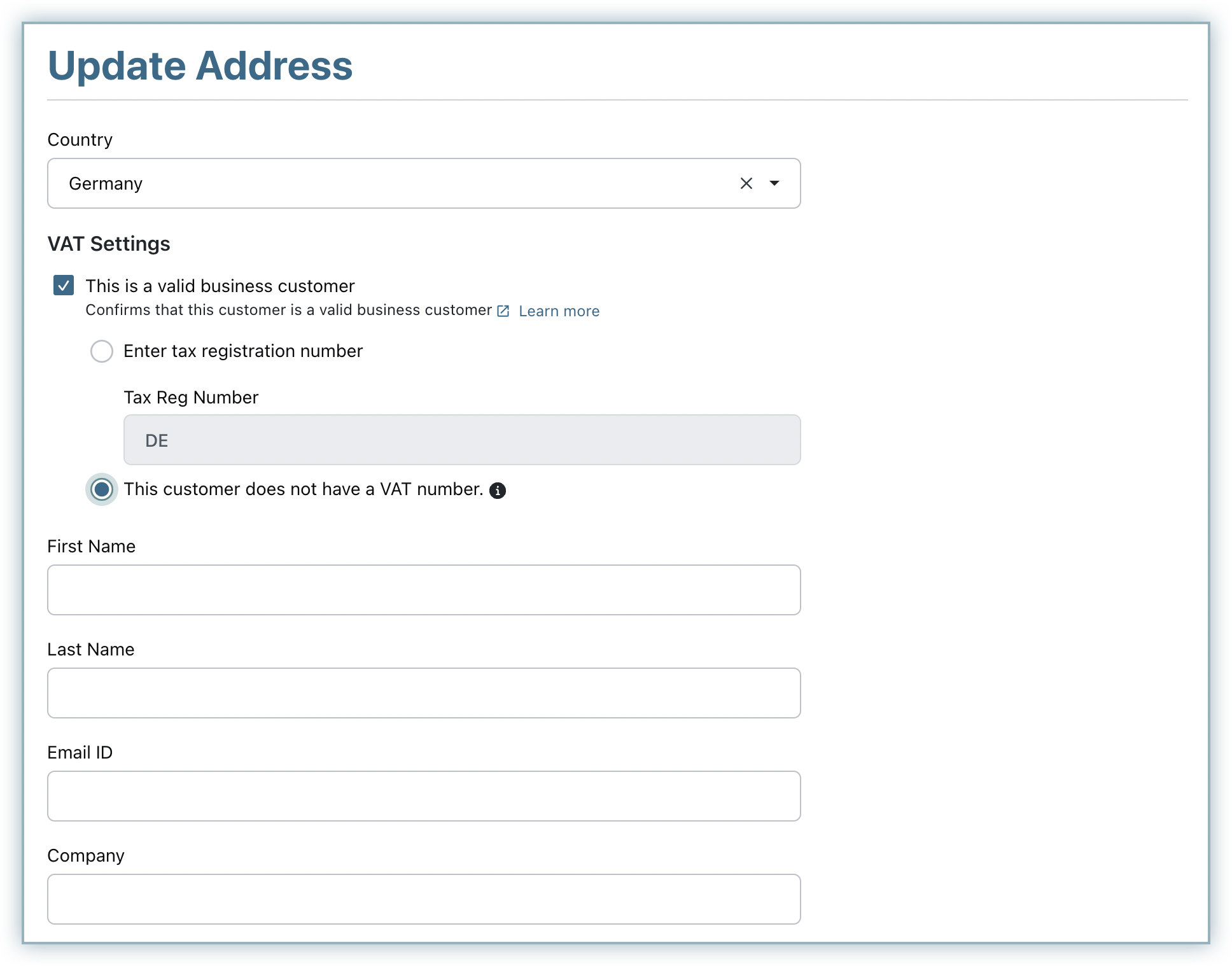

Source: chargebee.com

Source: chargebee.com

If you think youre eligible for a tax refund. How much is the VAT tax if we Top Up Free Fire using Indosat Credit now in the first example we will top up the Free Fire Level Up Pass at a price of 16K or 16000 Rupiah what is the VAT tax and how much total pulses we will spend. There are two sets of rates that are applicable for most goods. Raw wool including animal hair. 4 or 5 and 1250.

Source: docs.microsoft.com

Source: docs.microsoft.com

Therefore service tax would not form a part of sale price and consequently no VAT can be levied under the MVAT Act. There are two sets of rates that are applicable for most goods. Raw wool 5 Animal hair 0. It was held that payments of service tax and VAT are mutually exclusive. All other goods of local importance not notified by states as tax free goods.

Source: sufio.com

Source: sufio.com

The result is the VAT included. The value-added tax works very similarly to sales tax in the sense that every time a customer makes a purchase in the EU VAT is also applied during their transaction too. If you think youre eligible for a tax refund. Come under a VAT rate of 1 or 2. Now you go to the supermarket and buy fruit.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title update how much vat tax if top up free by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.